ESG investing is an investment strategy which consider both financial return and social/evnvironmental good to bring about social change regarded as positive by proponents.

ESG is an evaluation of a firms conscientiousness for social and environmental factors. It is typically a score that is complied from data collected surrounding specific metrics related to intangible asset within.

We must manage and mitigate long-term risks to the environment for our customers

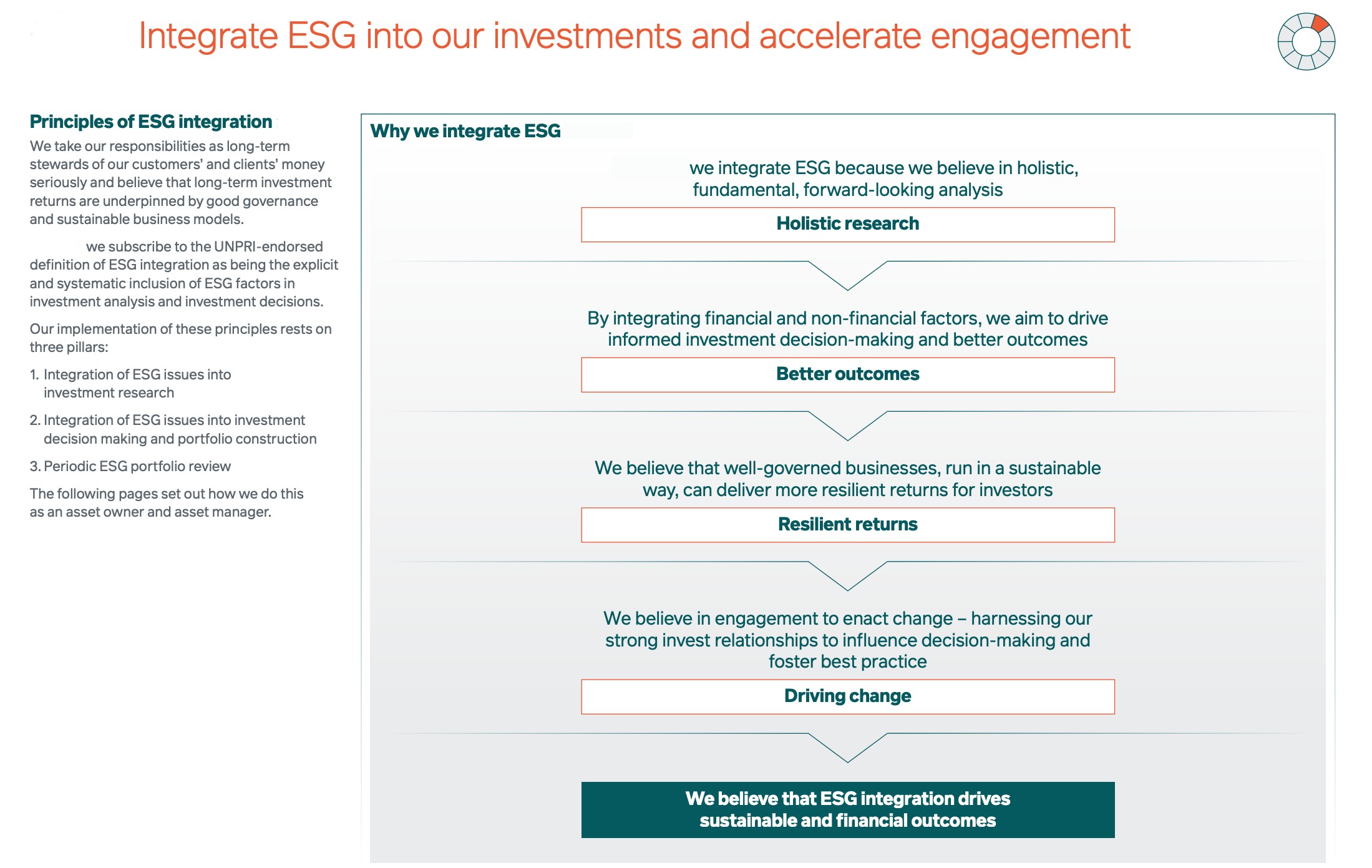

We believe a well-governed business run in a sustainable way delivers stronger, more resilient returns for customers, clients and shareholders, and better outcomes for society and the environment. In our sustainable investment approach, we are forward-looking, pragmatic and holistic. We do not focus only on carbon reduction: we are also starting to consider water and land use, the implications for biodiversity and natural capital, minimising pollution, promoting social equality and supporting a sustainable transition across our investee entities, their supply chains and their communities.

Climate change

Supporting the transition to a low carbon economy Scientific evidence shows that climate change is one of the biggest threats to our planet, and that carbon emissions are contributing to climate change. Through our global investments and the way we run our own business, we are playing our part in the transition to a low carbon economy.

Natural Capital

Preserving Natural Capital Biodiversity and natural capital – such as plants, animals, soils, minerals and ecosystems – are essential to life on earth, and also closely connected to climate change. We are working to better understand how to consider natural capital when making our investment decisions, and what opportunities we have to help preserve it.